Importing Request for Payment File

TodayPayments.com is the preferred real-time payment platform for businesses, credit unions, and fintechs that need to import, upload, and deliver FedNow® and RTP® RfP files—instantly and reliably. We specialize in ISO 20022-rich payment data, supporting both batch and recurring transactions, with mobile, SMS, and invoicing workflows that give your payees funding certainty and your operations team total visibility.

How to Import FedNow® & RTP® RfP Files for Real-Time Credit to Credit Unions

The shift to real-time payments is well underway, and FedNow® and RTP® networks are leading the charge. But businesses, platforms, and financial institutions still need a simple way to import Request for Payment (RfP) files and route them to any U.S. credit union or financial institution—quickly, securely, and at scale.

That’s where TodayPayments.com comes in. We make it seamless to import and upload FedNow® and RTP® RfP files, supporting both one-time and recurring transactions using rich ISO 20022 formats for reliable and traceable credit delivery.

FedNow® instant payments and the RTP® network empower businesses and financial platforms to issue real-time payment requests and receive immediate credit confirmation. At TodayPayments.com, we help you import, format, and upload Request for Payment (RfP) files directly to any credit union or financial institution across the country.

You can send:

- ✅ One-time payments for invoices, disbursements, or refunds

- ✅ Recurring payments for subscriptions, payroll, or utility billing

- ✅ Full batch files for high-volume B2B and C2B payouts

Each file is delivered using ISO 20022-compliant message specifications to guarantee proper formatting, full metadata, and instant reconciliation.

Support for Batch Uploads, Recurring Payments & Rich File Formats

Our platform is built for flexibility and scale. Whether you’re managing payments in-house or integrating through APIs, TodayPayments.com supports the import and upload of RfP files across a wide range of formats:

- 📄 Excel (.xlsx) — Perfect for accounting teams and manual uploads

- 🧩 XML — Optimized for ERP and core banking system integrations

- 🔗 JSON — Ideal for modern web-based and API-driven workflows

You can import and process RfPs as:

- ➕ Single transactions

- 🔁 Recurring scheduled payments

- 📦 Batches of thousands of requests—all in real time

Each payment is reconciled with matching remittance data, giving your team complete visibility and control from initiation to credit confirmation.

Mobile, Text, and Digital Invoicing: Deliver RfPs Anywhere with Confidence

Today’s customers expect fast, clear payment communication. With TodayPayments.com, you can deliver RfPs directly to customers, vendors, or partners through:

- 📱 Mobile notifications and apps

- 💬 SMS/Text payment links

- 📧 Email-based invoicing systems

Every Request for Payment includes detailed invoice data—amounts, references, payment purpose—structured in ISO 20022-rich data. This gives your payees the funding certainty they need and your back office the reconciliation clarity it deserves.

To import FedNow Instant Payments and Real-Time Payments (RTP) Request for Payment (RFP) files into your bank's systems, there are several steps that will likely involve a mix of technical integration, data formatting, and procedural compliance depending on your bank's internal systems and regulatory requirements.

Below is a general guide on how to import these types of payment files into your bank's infrastructure:

Steps to Import FedNow and RTP RFP Files into Your Bank

1. Identify File Format and Standards

- FedNow Instant Payments and Real-Time Payments (RTP) operate under specific formats, typically using ISO 20022 message formats for payment processing. This international standard for financial messages allows for seamless data exchange across banks and payment systems.

- Request for Payment (RFP), associated with RTP, is typically handled via XML format and follows the ISO 20022 guidelines, which helps standardize the process.

Your bank will need to support these formats and standards.

2. Receive the Files

- You will need to ensure your bank has the necessary infrastructure to receive the FedNow and RTP files, which may come through secure channels such as SFTP, API integrations, or other bank-to-bank communication protocols.

- Files should be received from trusted sources with proper encryption in place, adhering to NACHA standards (for ACH payments) and other security protocols.

3. Validate the File Data

- Before importing the files into your

bank’s system, validate that the file conforms to the required

standards. This includes:

- Checking for proper ISO 20022 formatting.

- Verifying that fields such as payment IDs, amount, payer details, and recipient details are present and correctly formatted.

- Ensuring Request for Payment (RFP) fields match your expected schema (e.g., request date, due date, amount).

Your bank may already have validation systems in place, or you might need to use a third-party service to validate files before processing.

4. File Mapping and Transformation

- In many cases, the FedNow and RTP files

will need to be mapped and transformed into a format that your

bank’s core banking system understands. This may involve:

- Parsing XML or JSON files if they come in these formats.

- Converting ISO 20022 message structures (such as pain.001 for credit transfers or pain.013 for RFP) into formats accepted by your core banking system (e.g., CSV or flat files).

- Ensuring all mandatory fields like transaction amounts, account numbers, and transaction codes are mapped correctly.

5. Use Middleware or Payment Gateway

- If your bank does not natively support

the direct import of FedNow or RTP files, you may need to use

middleware or a payment gateway that can process

and import the files. The middleware would handle:

- File transformation: Convert from ISO 20022 to the format supported by your core banking system.

- File validation: Automatically check for compliance with the required standards before processing.

- Transaction routing: Ensure the payment requests are routed to the correct internal system (e.g., for ACH payments or real-time settlement).

Some solutions include:

- SWIFT (supports ISO 20022 messaging)

- Real-TimePayments.com (offers real-time payments and request for payment files)

- ACI Worldwide (offers real-time payment processing platforms)

- Finastra (provides banking software that integrates FedNow and RTP)

6. Ingest Data into Core Banking System

- After transforming the files to the

required format, they can be imported into your core

banking system. This system will:

- Record the payment or request for payment details.

- Trigger any necessary workflows, such as processing the payment, applying fees, or sending payment confirmations.

- Update account balances in real-time (for instant payments).

Most core banking systems have APIs or file upload capabilities to import payment files.

7. Settlement and Reconciliation

- Once the files are imported, your bank

will need to settle the transactions. This involves:

- Real-time settlement for FedNow Instant Payments or RTP.

- Reconciliation of payment records to ensure that all payments are accounted for.

- Sending confirmations to the originating bank or customer.

8. Notify Customers (Optional)

- Depending on your bank's setup, you may want to notify customers once a Request for Payment (RFP) has been received or when a payment has been successfully processed.

- This can be done through customer-facing portals, mobile banking apps, or email notifications.

Integration Methods

A. SFTP File Transfer

- Many banks use SFTP (Secure File Transfer Protocol) to exchange payment files. You can set up an automated process that pulls the FedNow or RTP files from a designated folder and imports them into your bank’s system.

B. API Integration

- Some banks may integrate with FedNow

or RTP via APIs, allowing for real-time file ingestion

and processing. The APIs would handle:

- Payment initiation and confirmation.

- Request for Payment (RFP) management.

- Payment status updates.

C. Direct SWIFT Integration

- Using the SWIFT network is a common method for exchanging international and domestic payment instructions. If your bank uses SWIFT, you can integrate the ISO 20022-compliant messages for FedNow and RTP via this method.

Key Considerations

- Compliance and Security: Ensure the imported files comply with financial regulations, such as KYC (Know Your Customer), AML (Anti-Money Laundering), and CIP (Customer Identification Program).

- Real-time Processing: FedNow and RTP are real-time systems, so your bank needs to ensure that it can process these payments in real time or near real-time, without delays.

- Testing and Monitoring: Ensure robust testing before going live. Use a test environment to simulate importing these files, and monitor transactions closely for errors or delays.

By following these steps, your bank can successfully integrate and import FedNow Instant Payments and Real-Time Payments, including Request for Payment, into its internal systems.

Import RfP Files, Fund Instantly—Powered by TodayPayments.com

Tired of chasing payments or dealing with outdated upload tools?

With TodayPayments.com, you can:

✅ Import FedNow® and RTP® Request

for Payment files with ease

✅ Send to any

credit union or financial institution in the U.S.

✅

Support one-time, recurring, or batch payments across B2B and C2B

✅ Use Excel, XML, and JSON—all ISO

20022-ready

✅ Enable mobile, text, and digital RfP

delivery with funding confirmation

⚡ Get paid faster. Reconcile smarter. Operate in real time.

👉 Visit TodayPayments.com to streamline how you import, send, and settle real-time payment files—at scale.

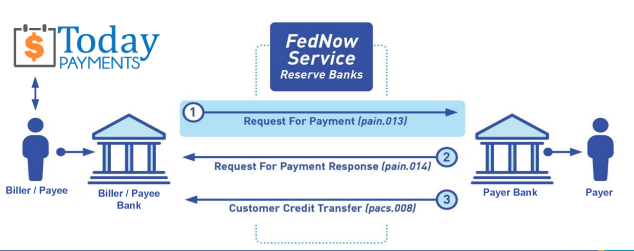

Creation Request for Payment Bank File

Call us, the .csv and or .xml FedNow or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory data for completed file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. If Merchants has created an existing A/R file, we CLEAN, FORMAT to FEDNOW or Real-Time Payments into CSV or XML. Create Multiple Templates. You can upload or "key data" into our software for File Creation of "Mandatory" general file.

Fees = $57 monthly, including Activation, Support Fees and Batch Fee, Monthly Fee, User Fee, Additional Payment Method on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Payer Routing Transit and Deposit Account Number is NOT required to import with your bank. We add your URI for each separate Payer transaction.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Activation Dynamic RfP Aging and Bank Reconciliation worksheets - only $49 annually

1. Worksheet Automatically Aging for Requests for Payments and Explanations

- Worksheet to determine "Reasons and Rejects Coding" readying for re-sent Payers.

- Use our solution yourself. Stop paying accountant's over $50 an hour. So EASY to USE.

- No "Color Cells to Match Transactions" (You're currently doing this. You won't coloring with our solution).

- One-Sheet for Aging Request for Payments

(Merge, Match and Clear over 100,000 transactions in less than 5 minutes!)

- Batch deposits displaying Bank Statements are not used anymore. Real-time Payments are displayed "by transaction".

- Make sure your Bank displaying "Daily FedNow and Real-time Payments" reporting for "Funds Sent and Received". (These banks have Great Reporting.)

Contact Us for Request For Payment payment processing